How Does Financing A Car Work

The newer the car the lower the rate.

How does financing a car work. Comparison shop to find both the car and the finance terms that best suit your needs. The financing and the car. Cars depreciate like crazyfor this reason alone its not smart to pay interest on a car loan. It is important to do some shopping both for the loan and the car then get your best price at the dealer before broaching the subject of financing.

The dealership will use a third party to provide the funds and may mark up the apr to compensate themselves for their role in the process. Think before you sign. Buying a car is a big financial decision. We can help make that challenge easier by walking you through the available payment options to help you work out whats best.

Financing a car may seem a little overwhelming particularly for a first time car buyer. If youre buying then youre probably financing it through the dealership a bank or credit union an online financial institute or maybe even a family member. Credit scores and car finance. Why paying for a car with cash is best.

You may find an exception to this rule at some credit unions. The contract however is between the customer and dealer. Most car buyers never think twice about the financing options they are offered at the dealership. You are shopping for two products.

From the point of view of the buyer a car loan works like the key that gets you into a vehicle you may not otherwise be able to afford. This means that youre either going to be leasing the car or buying the car by financing it. If you have ever bought a new car before you probably have a pretty good idea how financing works. Using a personal loan to buy a car.

Indirect lenders auto dealers offer customers the convenience of getting their car and financing at the same time. Some give the same interest rate for new and used cars you may find an exception to this rule at some credit unions. Negotiate the terms and consider several offers. How car financing works.

Finding just the right car can be a challenge and part of that challenge is deciding how to pay for it. Find out how car financing works and how loan terms and down payments can impact the overall cost of your vehicle purchase in this article from better money habits. Car loans can be beneficial to both parties if you understand how they work and what to avoid. You car is not an investment.

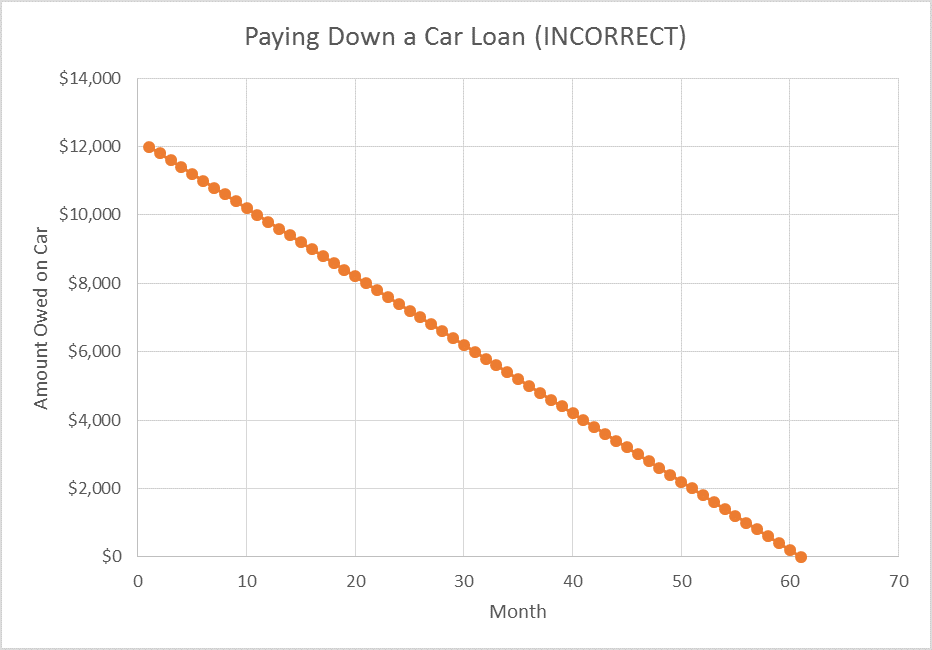

What happens in most cases is that the car depreciates and the value of the car drops faster than you repay the loan leaving you upside down or underwater when you owe more on the loan than the car is worth.